Diamond Resale Value

How much is your diamond really worth?

We are reader-supported. Buying through any red colored link on our site may earn us commissions. Learn More.

How much is your diamond really worth?

\If you’re thinking of selling your diamond ring or other diamond jewelry, you likely have several questions about its resale value. While a diamond’s resale value changes along with the current market trends, the diamond’s quality is still enormously important. For example, this 3.08 carat round diamond may seem like a phenomenal value. But not only will it look bad (due to its poor cut), it will be virtually impossible to re-sell this diamond. On the other hand, this 3.15 carat may seem a little pricey in comparison but its worth it. Not only will it look stunning, but it will retain its value far better than the previous diamond.

Even if you purchased a great diamond at a good price, you are likely to get half of what you originally paid. Diamonds have increased in value over every decade, but you did purchase the diamond at retail. Understanding how much your diamond is worth at a retail and resale value is important.

We will explain all of this in detail, but the fastest way to find out how much your diamond is worth is to contact Abe Mor. Abe Mor has been our go-to recommendation for people looking to sell their diamond and gold jewelry. Our readers have given us consistent feedback that the process was great and they received better offers than they did elsewhere.

As we mentioned in our guide to selling a diamond ring, we’re often contacted by readers who are considering selling their diamond jewelry. Most of these readers, very understandably, want to get the highest possible price when selling their diamonds.

While diamonds do have resale value, it’s very unlikely that you’ll be able to sell your diamond ring for the same price that you or your fiancé paid for it when it was new. In fact, in just about every case, you can expect to sell your diamond at a significant loss.

However, your diamond ring or other jewelry’s resale value can depend on a variety of factors, all of which we’ve covered below.

Diamond resale value

How much can I sell my diamond ring for?

Do diamonds increase in value over time?

FAQs

Why you should trust us

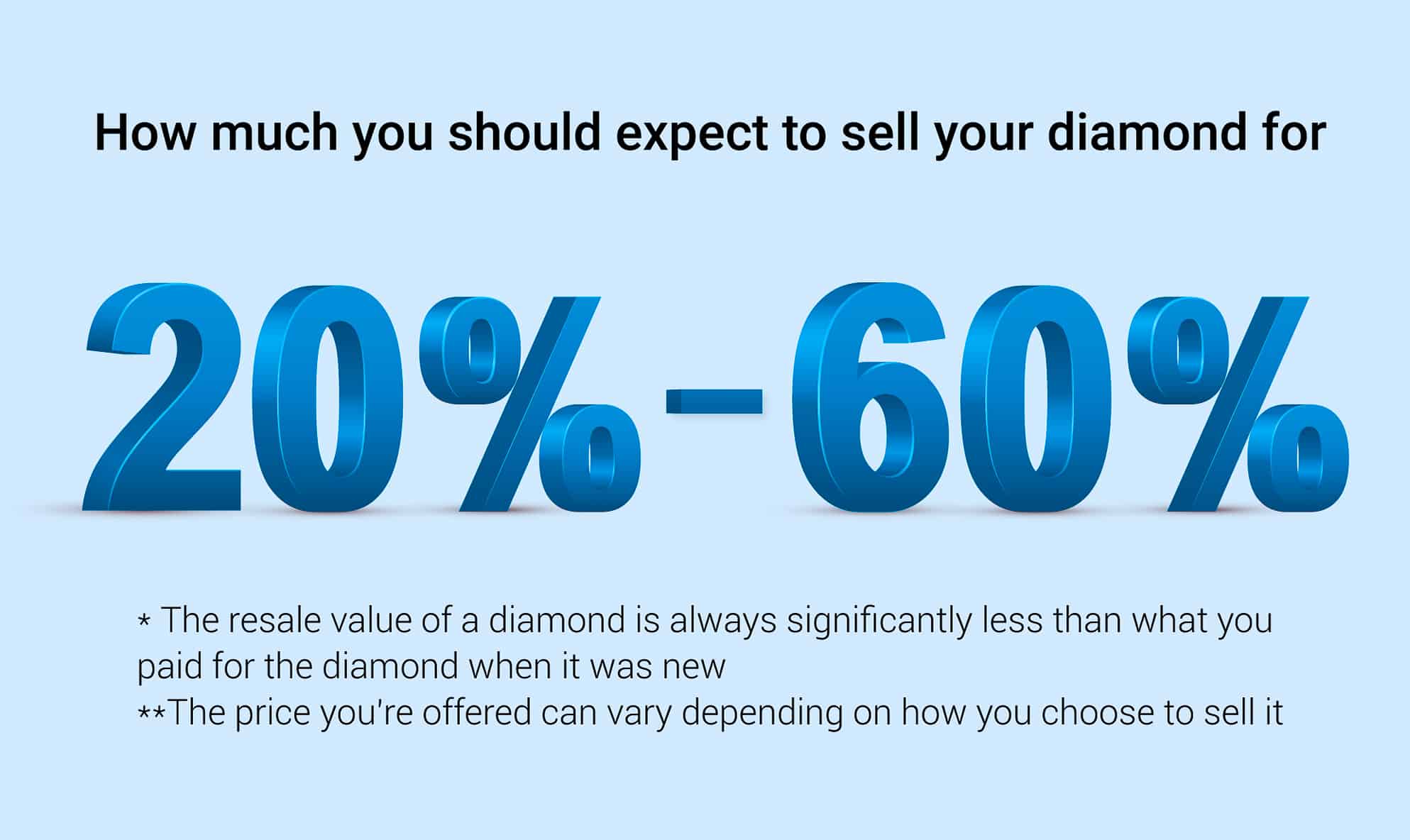

All diamonds, from the center stone of an engagement ring to a pair of diamond earrings, have resale value. However, the resale value of a diamond is almost always significantly less than the amount you or your fiancé paid to purchase the diamond when it was new.

There are several reasons for this, from the diamond’s retail markup (this can vary depending on where you purchased the diamond) to the difficulty of reselling a pre-owned diamond.

The price you’re offered for your diamond can also vary hugely depending on how you choose to sell it.

We’ve covered these reasons in more detail below. In most cases, a diamond engagement ring or other diamond jewelry will have a resale value of between 20 and 60% of the amount it cost when it was new.

Because no two diamonds, vendors or potential buyers are the same, there’s no precise answer to this question.

As we mentioned in the section above, you’ll almost always lose money if you sell your diamond ring or other jewelry. The precise amount you’ll lose depends on several factors:

Let’s start with the first factor. When you purchase a diamond from a jewelry store, you not only pay the market value for the diamond — you also pay the markup added to the price by the retail store that’s selling you the diamond.

This markup can vary depending on where you buy the diamond. To explain this, we need to go into a bit of detail about how the supply chain for diamonds works.

Obviously, retail jewelers don’t mine, cut and polish their own diamonds. Instead, they buy them from a wholesaler, who in turn buys them from a diamond manufacturer. Each link in the supply chain results in an additional margin being added to the price the jeweler pays for the stone.

Then, there’s the markup added to the diamond by the retailer. Since brick-and-mortar jewelry stores need to pay for things like rent, staff salaries and utilities, their diamond markups can be very high.

In some cases, diamonds sold by brick-and-mortar jewelers are marked up by 100% or more of their cost to the jeweler (this is called a keystone markup). Essentially, you’re paying twice what the jeweler paid the wholesaler for the diamond.

If you buy online (e.g. from Blue Nile or James Allen), you’ll pay a significantly smaller markup — most of the time, around 18%.

This means that you won’t ever make money reselling a diamond that you purchased new from a jewelry store. Even if the store buys it back from you at 100% of its new market value, there’s a significant markup placed on the new diamond that you won’t get back.

The second factor is how much the diamond is worth. As we’ve explained in our guide to the diamond 4 Cs, diamonds vary in value based on factors such as their cut quality, color, clarity and carat weight. Other factors also affect a diamond’s value, although these factors (the “4 Cs”) are the biggest.

When you sell a diamond to an informed buyer, such as a jewelry store, they’ll look at the GIA or AGS (or, in some cases, other lab) certificate that came with the diamond. This certificate is an independent lab evaluation of the diamond’s quality.

Obviously, jewelry stores and other buyers will usually be willing to pay more for a high quality diamond than for a poor quality one. However, even a diamond with an outstanding evaluation will be worth less than the amount you paid for it at retail.

The final factor is where you choose to sell your diamond. In our guide to selling a diamond ring, we bought a diamond ring from Tiffany & Co. to see how much we’d be offered for it by different diamond buyers.

The ring, which cost $4,500, was a 0.53ct round diamond in a classic Tiffany solitaire setting. It’s worth noting that Tiffany & Co. charge a very high price for the diamond rings, meaning we were anticipating a significant difference between what we paid and what we’d be offered.

We sent the ring to three different companies that purchase pre-owned diamonds — White Pine Diamonds, Worthy and Abe Mor. Abe Mor gave, hands-down, the best offer, offering us $1,850 for the ring, or about 41% of its original price.

White Pine Diamonds and Worthy offered us $1,000 (22% of the ring’s retail price) and $1,200 (27% of its retail price, after Worthy’s commission was deducted), respectively.

In short, the best offer we received for a $4,500 ring was $1,850 — just over 40% of the amount it cost at retail.

Now, it’s important to reiterate that Tiffany & Co. rings have an incredibly high markup, meaning this type of loss is expected. A diamond ring Blue Nile or James Allen would have a significantly lower markup, meaning you’ll lose a lower percentage of its original value if you sell it.

Still, it’s clear that regardless of where you sell your diamond, you won’t get its retail price back. In a best-case scenario, you can expect to receive between 20% and 60% of what the ring originally cost, depending on where it was purchased.

Like the question above, there’s no precise answer to this question. Diamond prices fluctuate over time. Over the last decade, diamond prices increased in the years directly after the Great Recession before declining slowly but steadily since the beginning of 2012.

As with precious metals, luxury watches and other high-end goods, there’s a public perception that diamonds can be safe, profitable investments. In almost every case, this doesn’t match up with reality.

In general, diamonds do not increase significantly in value over time. Outside of a small number of rare or colored diamonds, the vast majority of diamonds have decreased slightly in value over the last few years, making them a poor investment from a price appreciation perspective.

However, over a longer time period, diamond prices have increased. Statistica is a worldwide expert on statistical research. They show a more than tenfold increase in the market price of diamonds per carat for the period from 1960 to 2016.

At first glance, this can make diamonds look like a good investment. However, the reality is that investing money in just about anything else would have produced a better return on investment over the same period than purchasing and keeping a diamond.

For example, based on historical market data, $1,000 invested into the S&P 500 in 1960 would have grown to approximately $213,690 by the end of 2016, providing a far better total return on investment than that offered by a diamond.

There’s also the issue of inflation. Yes, the average diamond price has increased from 1960 to today. However, there’s also been cumulative inflation of more than 700% over the same time period, meaning that the true appreciation in value of a diamond is very small.

Once you account for the retail markup you pay when you buy a new diamond and the difficulty of selling a diamond back to a jeweler at its true value, it becomes very unlikely that even a high-quality diamond will appreciate in value in a practical sense.

To answer a question we get frequently, diamonds are not worthless. Diamonds may not retain the full retail value when purchased, but they retain quite a bit (roughly half). Historically, diamonds have increased in value over time as well.

Diamonds are not a good investment compared to traditional investments, but they are an excellent investment compared to most luxury goods. For example a new car loses 50% of the value when you drive it off the lot (like a diamond). However, diamonds have historically increased in value over time. Most other luxury purchases continue to depreciate.

Diamonds do have resale value, meaning you’ll be able to get some money back if you decide to sell your diamond ring or other diamond jewelry. We recommend reaching out to Abe Mor to find out how much you can get for your diamonds.

However, you’ll almost always lose money when you sell your diamond. Because of the markup that’s applied to diamonds, most jewelers, pawn shops and other buyers will only offer a fraction of what you paid for your diamond if you sell it to them.

If you’re thinking of selling your diamond ring, our guide to selling a diamond can help you avoid getting ripped off and make sure you get the best possible offer.

Before you buy a diamond, get personal buying advice from industry veterans. We'll help you get the best diamond for the money.

DISCLAIMER: We don't use your email for marketing. Period.

A diamonds’ price is determined primarily by the 4 Cs of the diamond. On the wholesale level, diamond prices are first based on a diamond shape and

Buying an engagement ring is often one of the first major purchases in a person's life. The process can be fraught with tension as there are so m

A wide range of 1 carat diamonds exist both in online markets and local diamond jewelry stores. Not only are there significant differences in beauty

Please enter your email address to receive your 25% off coupon code:

Here is your coupon code: GFDSF3GF